Table of Content

Mortgage rates are near their highest levels in 20 years after consistently climbing since January, when rates were still historically low and closer to 3%. No matter what term length you choose for a mortgage, it's important to do your research and interview numerous lenders before committing to one. This will help you find the lowest rate and fees available for your personal financial situation. The more lenders you talk to, the greater your chances of finding a lower rate. Even half a percentage point can make a big difference in the amount of interest you pay over the life of your mortgage.

It’s possible to wrap these fees into the loan, but doing so will cost you in the long run because you'll wind up paying more in interest. The table below brings together a comprehensive national survey of mortgage lenders to help you know what are the most competitive 20-year mortgage rates. This interest rate table is updated daily to give you the most current rates when choosing a 20-year fixed mortgage loan. The following table shows monthly principal & interest payments for 10, 15, 20 & 30-year FRMs along with 5/1 ARMs on a home loan of $220,000. These rates were current as of publication, though market conditions regularly change.

Home Loan Resources

A 20-year fixed mortgage has a flat interest rate for the full 20 years. Monthly mortgage payments remain the same, while principal and interest totals vary with amortization throughout the life of the loan. Every mortgage includes some upfront closing costs for processing and to pay the expenses of writing the loan policy.

Lenders nationwide provide weekday mortgage rates to our comprehensive national survey to bring you the most current rates available. Here you can see the latest marketplace average rates for a wide variety of refinance loans. The interest rate table below is updated daily to give you the most current refinance rates when choosing a home loan.

Is a 20-Year Mortgage a Good Option for Refinancing?

And if the Federal Reserve decides to slow down on rate hikes, as Fed Chair Powell hinted on December 1, we could see further declines (or at least a leveling-off) in the future. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. And here are some reasons why a 20-year mortgage may not make as much sense as a 30-year home loan. Mortgage rates may increase by the end of the year, so if you're looking for a new home it could make sense to buy now, rather than waiting.

Experts are divided on whether they’ll continue to climb—some forecasts put the year-end average at nearly 7%—or stay flat from here. If you’re in the market for a mortgage, you should check rates frequently, and always comparison shop for lenders. The main benefit of a 20-year mortgage is the savings homeowners receive from lower interest rates and paying it off sooner than 30 years. For instance, if you purchase a home for $300,000 and put 20% down. Instead of a 30-year mortgage at 3.25%, you opt for the 20-year term at 3%, you can save around $49,313.50 in interest throughout the lifetime of the loan.

Comparing different mortgage terms

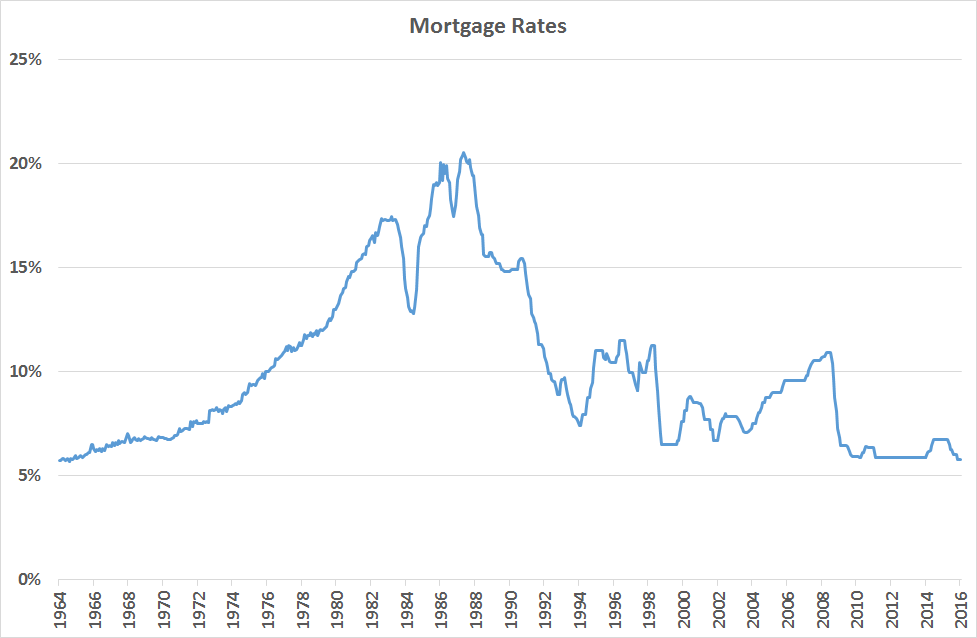

In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019. If rates drop significantly, homeowners can always refinance later on to cut costs. Although fixed mortgage rates are not controlled by the Fed, they’ve been spurred much higher by its actions.

Although the Fed’s strategy helped push inflation back to normal levels by the end of 1982, mortgage rates remained mostly in the double-digits for the rest of the decade. At the current average rate, you'll pay $634.70 per month in principal and interest for every $100,000 you borrow. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

A 20-year mortgage has more affordable monthly payments than a 15-year mortgage. Although you’ll most likely save even more in interest with the 15-year mortgage, the monthly payment will be higher, which can be burdensome for some borrowers. You can obtain a 3.5 percent down payment loan with a credit score as low as 580, and you can obtain a 10 percent down payment loan with a credit score as low as 500. FHA loan interest rates may be competitive compared to those for conventional mortgages. The above mortgage loan information is provided to, or obtained by, Bankrate.

The 15-year forces greater discipline & allows outright ownership of the home in half the time. Comparing 20-year mortgage rates across different lenders, you can see what rates, terms, and loan amounts you qualify for. In turn, you can snag the 20-year mortgage rates with the lowest interest rates, flexible repayment terms by comparing quotes from lenders. Nevertheless, you should not solely rely on the interest rate when determining whether it is time to refinance. You’ll also need to weigh how long you have left to pay off your current mortgage and to consider the repayment term of a new home loan.

Homeowners who want to pay off a mortgage faster than the conventional 30 years and save on interest costs should consider a 20-year home loan. With rates at historic lows, it’s a great time to start searching for the best 20-year mortgage rates to help you save tens of thousands of dollars over the entirety of your mortgage term. The costs and fees with a 20-year mortgage are similar to those of mortgages with other repayment terms. Expect to pay an average of about 2 to 4 percent of the loan’s principal amount atclosingin fees, including origination fees and third-party costs like title insurance.

This time a month ago, the average rate on a 30-year fixed mortgage was higher, at 6.85 percent. At today’s interest rate of 5.77%, a 15-year fixed-rate mortgage would cost approximately $831 per month in principal and interest per $100,000. You would pay around $49,667 in total interest over the life of the loan. Both interest rate and lender fees are captured in the annual percentage rate, or the APR. When interest rates are low home buyers have a strong preference for fixed-rate mortgages.

Different mortgage types usually have different rates, so do your research. For instance, adjustable-rate mortgages have lower initial rates but will fluctuate afterward depending on current market conditions. Fixed-rate mortgages may be higher but borrowers don’t need to worry about rates changing throughout the entirety of the loan term.

The disadvantage to the borrower, however, is that the monthly payments are higher and qualifying may be more difficult. Equity buildup from a 20 year fixed mortgage rises faster than a 30 year loan. Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates.

Loan Costs and Fees

Some rate quotes assume the home buyer will buy discount points, so be sure to check before closing on the loan. According to Freddie Mac’s records, the average 30-year rate jumped from 3.22% in January to a high of 7.08% at the end of October. Keeping your total debt, including your mortgage, at or below 43% of what you earn before taxes (known as your debt-to-income ratio, or DTI).

No comments:

Post a Comment