Table of Content

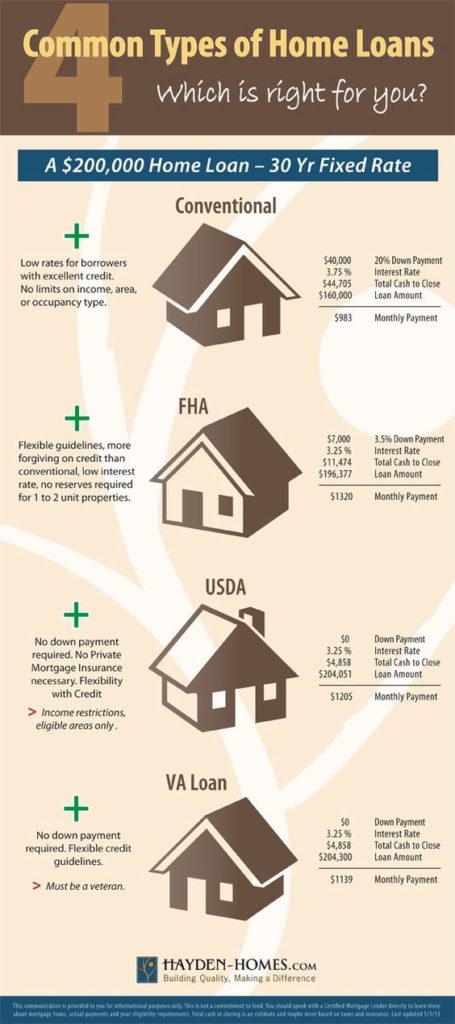

Being a Mortgage Manager, their home loan products are a little restricted compared to many other banks. With this being the case you have a really basic internet banking facility, no offset account and only have a redraw facility. Edge home loans are highly competitive when it comes to rates, and Edge comes with the added benefit of fee-free additional repayments for those looking to get ahead with their home loan. Find out more below as to what makes Edge a great home loan.

Note this review, interest rates and product information are correct as at 7th February 2019 and all of this information is subject to change without any further notification. Any applications for credit are subject to meeting the specific bank’s criteria and the decision is at their final discretion. For peace of mind Unlimited Redraw is only available to your nominated bank account. Redraw is subject to loan terms and is only available where you have available credit on your variable rate loan. Edge is a competitive variable rate home loan with low upfront fees.

Maximise your redraw facility with Edge

However, there are some types of loans that would benefit from working with Advantedge, like as we said, those with a big deposit. It is also called the following, but in all cases, they offer the same variable, fixed and combo products. Another downside of Advantedge is that you won’t have access to a branch because they work through other banks. So if you enjoy waltzing into your branch with a whole list of questions, this one isn’t for you.

If you made payments during the COVID-19 suspension, click here for more information. We work with the growth engine of our economy, small and mid sized businesses, to help them grow and save them money by simplifying their Payroll and HR needs. Whether you’re viewing your loan information or your recent transactions, we’re here to help.

Who is Advantedge best for?

Mortgage Broker Brisbane - Hunter Galloway is an Award Winning Mortgage Broker based in Brisbane. We believe buying a home should be stress-free and uncomplicated, and we will work for you to make your dreams become reality. Schedule a call today with a Home Loan Expert from Hunter Galloway, the home of home buyers. As mentioned before, Advantedge used to trade as Challenger, so its previous customer reviews are still under this name. The slightly confusing thing is that Advantedge uses a bunch of different brands, but the product in the background is the same. So let’s get started with my review on Advantedge Financial Services and see it really is the dark horse of the finance industry.

Our expert team of Mortgage Brokers is ready to help you with the next steps of your home loan journey. The answer to this question will help us determine the chances of you securing a loan. If you don’t know the exact price of your property then we can use an approximate value.

Why Partner with AdvantEdge HR to Provide Payroll Services?

You may adjust the property price at any stage of completing this form before final submission. Lenders Mortgage Insuranceis much cheaper with Advantedge compared to other lenders in the market. Advantedge’s application checklist is fairly standard compared to most banks and assuming you are a salaried employee and you are purchasing your first home they would ask for the following documents. You can check out Advantedge’s application formwhich also includes the document checklist on page 2. You could say Advantedge Financial Services is like the dark horse of the finance industry.

We work with the growth engine of our economy, small and mid sized businesses. Please note that the Advantedge Office address has changed. Moving forward, please use our Postal address which can be foundhere. Access your home loan information by activating your StarNet account.

Part of the National Australia Bank Group , Advantedge Financial Services Pty Ltd has been delivering simple, quality home loans with great service to Australians for over 25 years. The same convenient access to your loan account - just simpler and smarter. Check out our video guide to familiarise yourself with the new site. Advantage Refinance Loans are considered new loans which provide new benefits and features.

You earn 1 point for every dollar spent with your AdvantEdge Card every time you purchase qualifying items at any Price Chopper, Market 32, or by shopping online atpricechopper.com. Rewards points also have more exclusive options found online atrewards.pricechopper.com. If you are a member of the military, your federal loans may qualify for the Servicemembers Civil Relief Act and other military benefits. You didn't go into business to handle payroll, benefits, HR and life insurance, but we did.

AdvantEdge Rewards is our promotion that allows you to earn points when you shop. Points can be redeemed for savings on a future order at any Price Chopper or Market 32 location for more exclusive options online atrewards.pricechopper.com. To learn about the Department of Education's announcement related to changes to income-driven repayment plans, click here. Advantedge is a member of the National Australia Bank Group .

They have one of the cheapest LMI prices in the market based on our test scenario below, and could save you a few thousand dollars if you have to pay LMI. The Biden-Harris Administration is seeking to overturn those orders. For the latest information regarding the status of student debt relief, visit StudentAid.gov. Our Cloud based Payroll and HR system allow businesses to access their data and processes securely anytime, anywhere.

For undergraduate, graduate and professional level students who need additional funds, we provide a way to help pay college expenses. Please enter your details below, and one of our Mortgage Brokers will be in touch with you over the next 4 business hours with the next steps. Give you full transparency, and personalised advice with the best loan products in your situation. The answer to this question will allow us to identify the best loan options for your needs. Figures as at 7 February 2019, subject to credit criteria and will change without notification. The information provided is a short summary and is not everything you need to know to select a product and features that are appropriate for your needs and requirements.

It’s there, behind the scenes and working it’s magic, but nobody sees it. Approximately 40% of home loan applications were rejected in December 2018 based on a survey of 52,000 households completed by 'DigitalFinance Analytics DFA'. In 2017 to 2018 Hunter Galloway submitted 342 home loan applications and had 8 applications rejected, giving a 2.33% rejection rate. AFG Home Loans EdgeTM is funded by the Advantedge residential loan program. Buying your first home is exciting, but it’s a big step to take and one that comes with many questions and decisions. AdvantEdge Rewards point balances are printed on your receipt, found in your profile on the Price Chopper mobile app or at pricechopper.com, as well as shown in your account at rewards.pricechopper.com.

No comments:

Post a Comment